It’s interesting to realize there is some similarity between the CAP theorem and the Impossible Trinity.

The CAP theorem works in theoretical computer science, states that it is impossible for a distributed computer system to simultaneously provide all three of the following guarantees:

- Consistency (every read receives the most recent write or an error)

- Availability (every request receives a response, without guarantee that it contains the most recent version of the information)

- Partition tolerance (the system continues to operate despite arbitrary partitioning due to network failures)

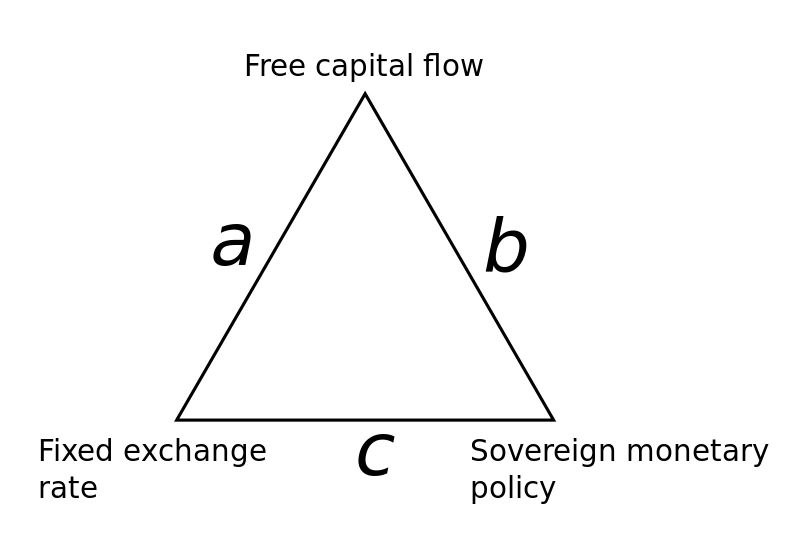

The Impossible Trinity works in international economics, states that it is impossible to have all three of the following at the same time:

- A fixed foreign exchange rate

- Free capital movement (absence of capital controls)

- An independent monetary policy

There is some kind of equality as described below.

| CAP Theorem | Impossible Trinity |

|---|---|

| Consistency | A fixed foreign exchange rate |

| Partition tolerance | Free capital movement |

| Availability | An independent monetary policy |

Like a distributed architecture in computer science, a country has to choose between of the three. If a economic entity choosed consitency and availability at some time, because of the capital movement can not be blocked totally, it can not guarantee consitency forever.